2021 was a historic year for venture capital in the world, but especially for Chile. According to figures collected by the Chilean Venture Capital Association, VC investment in the country grew by 541% compared to 2020.

The figures are part of the ACVC Impact Report 2022, which the association has just published, and which DFMAS highlighted in its latest edition.

In 2021, the country reached a record investment of US$ 1,025 million, which was distributed in 339 deals, with an average investment ticket of US$ 3 million.

Meanwhile, at the regional level, investment in Latam reached US$ 15.7 billion in 2021, more than three times the previous record of US$ 4.9 billion, achieved in 2019. But in addition, what was invested in 2021 exceeded everything financed in the region in the last 10 years.

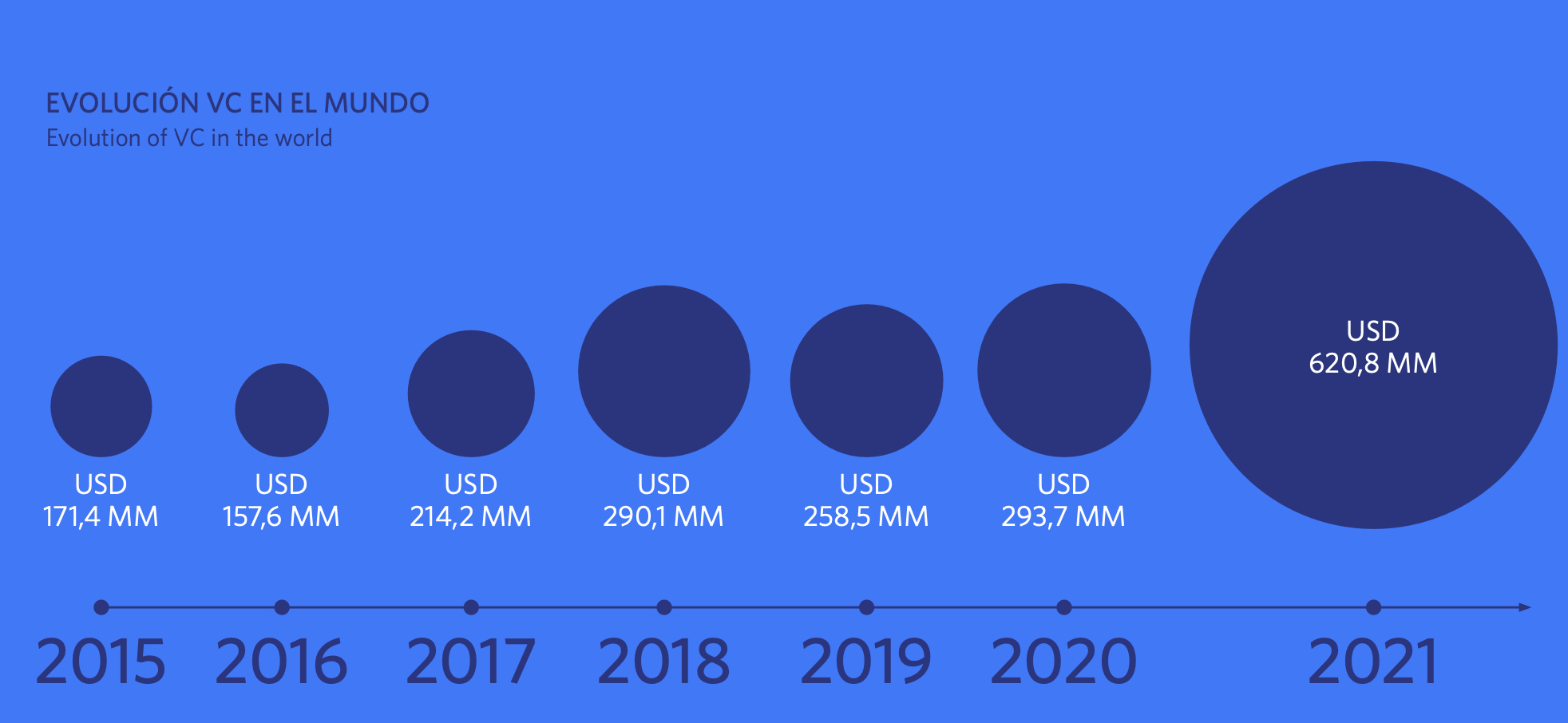

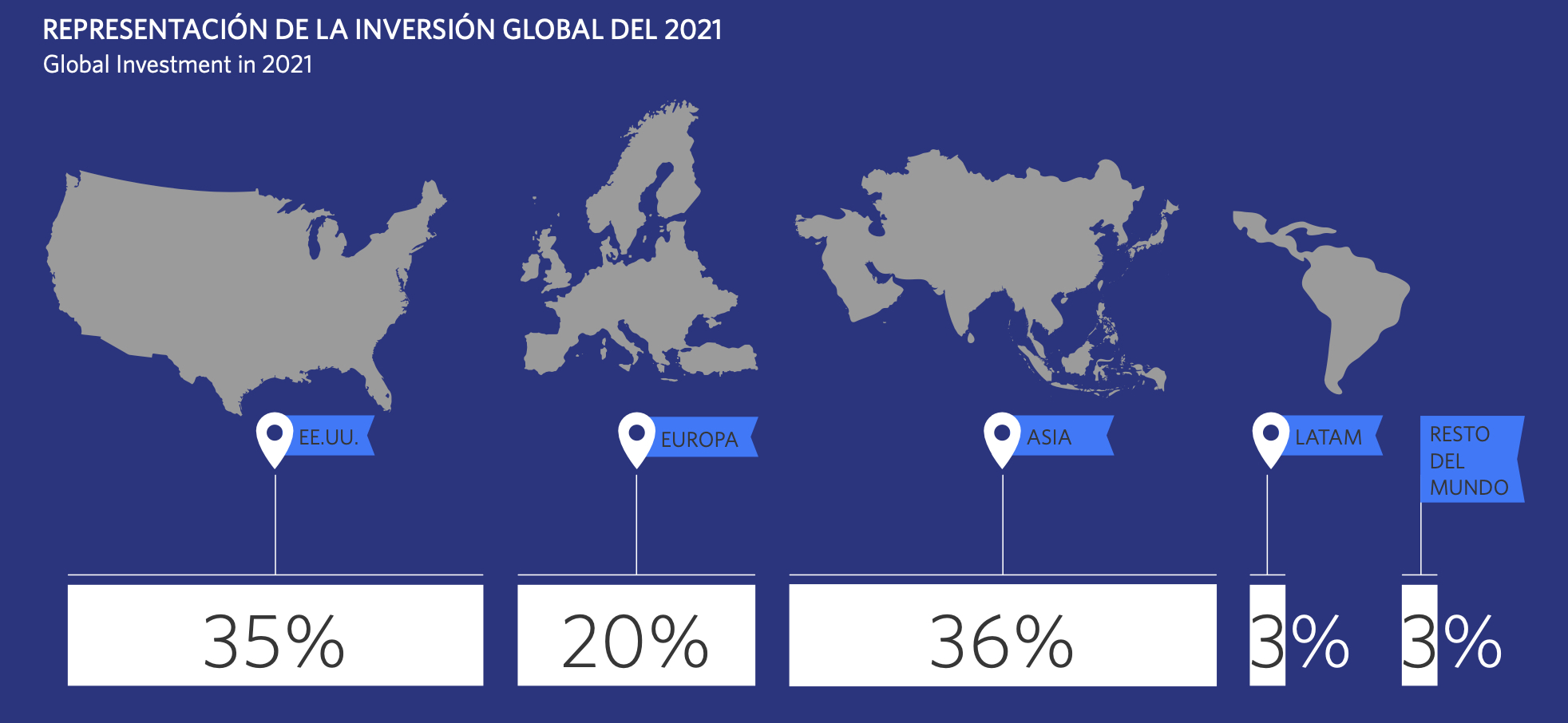

Globally, Venture Capital investment globally was US$ 621 billion, more than double the amount invested in 2020, which was close to US$ 300 billion. In addition, the fourth quarter of 2021 closed the year with an all-time high of US$ 176 billion. Although all regions had record investments, reflecting the globalization of innovation capital and the new opportunities offered by the pandemic, the United States led the ranking, followed by Asia, Europe and Latin America.

On the other hand, the global total of unicorns reached 959 in 2021, up 69% from 2020, and with a staggering 517 new unicorns during the year.

Corporate Venture Capital (CVC) has experienced explosive growth worldwide in recent years. According to CBInsights, in 2021 the global CVC reached a record in its investments with an increase of 142% over the previous year, with a total invested amount of US$ 169.3 billion. While deals increased 39%, from 3,356 in 2020 to 4,461 in 2021. Of the total financed, 86% of the funds were concentrated in seed, series A and B rounds. Meanwhile, mega-rounds, or those exceeding US$ 100 million, increased by 163%, totaling US$ 104.8 billion.